The key factors that will drive Mobile Financial services’ growth

By: Pavan Ramkishan Bachwal, Acting Chief Commercial Officer (Financial Services)

Telcos’ current situation is tricky. They face a market where traditional revenues are declining, and the market is uncertain. As such, any market that can generate additional revenue streams for operators is vital. Therefore, the mobile financial services (MFS) market is of central importance and can drive new growth for operators.

However, mobile money is a complex market with many different trends, and it can be difficult to unpack the key factors to watch and for operators to prioritize for growth. To assist in this task, Ericsson and Juniper Research have created a new study, What Will Drive Mobile Financial Services Growth. The study surveyed decision-makers responsible for MFS at Mobile Network Operators (MNOs) across 4 key regions. The survey included 46 respondents from 46 MNOs in 35 countries, all from MNOs that currently offer MFS.

The top ten findings from the study are listed below:

- 40% of Mobile Network Operator User Bases Will Be Actively Using Mobile Financial Services in the Next Five Years

- 80% Growth in Mobile Financial Services Transaction Value Anticipated Over the Next Five Years

- Customer Incentives, Extensive Last-mile Networks, and COVID-19 Digital Payments Surge Lead Top Ten Factors That Have Accelerated Mobile Financial Services Success

- Advanced Services to Drive Mobile Financial Services Growth Over the Next 5 Years

- QR Code, AI/ML, and NFC Lead List of Technologies That Will Have Most Impact on Mobile Financial Services Over the Next Five Years

- Mobile Network Operators Are Focused on Extending Payments and International Remittances via Partnerships with Merchants and Money Transfer Operators

- Regulations and Taxation, Enduring Preferences for Cash and Security Concerns Are Key Challenges Inhibiting MFS Growth

- Service Portfolios Are Evolving Rapidly, with Banking Tech and Value-added Services Taking the Lead

- Mobile Financial Services Critical for Enabling Revenue Growth and Diversification for Mobile Network Operators

- Enabling SDGs, Access to Formal Financial Services and Financial Inclusion Are the Biggest Social Benefits of Mobile Financial Services

For now, we will examine two key findings – finding four and finding eight.

Advanced services to drive mobile financial services growth over the next five years

Ultimately, to maximize their future chances, MNOs must understand what factors will drive MFS growth and where to focus their limited resources. Operators stand at a crossroads in many markets, with competition from fintechs, banks, and social media financial services becoming paramount.

MFS providers must increasingly focus on advanced services like sophisticated micro-finance services, loans, overdrafts, BNPL, investments, merchant payments, bulk payments, etc. By doing this, they can begin to transition their large user bases to these more advanced services, driving additional revenue streams, offsetting the potential loss of business to new competitors, and reducing user churn.

Vendor priorities are clear: enhanced user experience, greater personalization, offering a comprehensive service portfolio, convenience and ease of use, security and trust, and driving growth. These priorities will reshape the way MFS providers operate, shaking up their revenue models, product portfolios, and user experiences. MFS providers must prepare for this disruption now, or new fintech and technology company competitors will leave them behind.

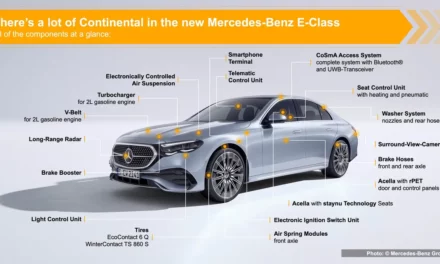

Service portfolios are evolving rapidly, with banking tech and value-added services taking the lead.

The MFS market is highly varied, with MNOs taking different approaches based on which markets they operate within. When looking at which services MFS providers offer, there are a multitude of other ways to provide them. As such, we asked our respondents which services they presently offer, which they expect to expand in the future, and which they do not intend to pursue.

Figure 1: Categorisation of Different Services

Source Juniper Research

Conclusion

Examining these two key trends alone makes it clear that the MFS market is undergoing a significant amount of change. MNOs understand their priorities, and as such, they need to choose technology platforms and vendors that enable them to reach their next phases of growth. If they get this choice right, they will be well set to capitalize on future market opportunities.

For further details on this study, diving into every one of our key ten findings, please download What Will Drive Mobile Financial Services Growth here.