Moody’s: Saudi Banks’ Rising Provisioning Charges Erode Profits

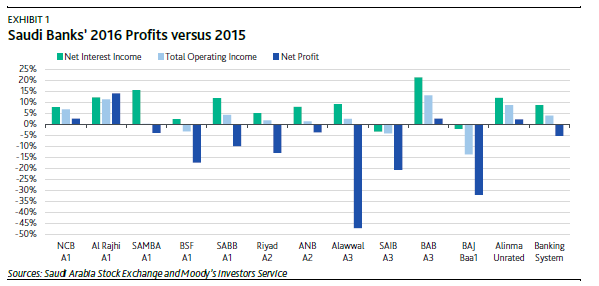

Last Thursday, the last Saudi domestic bank submitted its preliminary financial results for 2016 to the Saudi stock exchange. Saudi banks reported a 5.4% year-on-year decrease in net profits, mainly because of rising provisioning charges, a credit negative.

The provisioning increase reflects asset quality challenges amid low oil prices. In line with 2016 results, we expect that Saudi banks’ profits will remain challenged in 2017 amid an increasing cost of risk and subdued credit growth that, despite easing funding costs, will negatively affect top-line revenues.

An 8.7% year-on-year increase in net interest income confirms that banks boosted gross margins during the year to absorb the increased cost of funding that occurred in the first half of 2016.

However, that annual growth was mostly offset by a 6.1% reduction in non-interest income, leading to a 3.8% growth in operating income (see Exhibit 1). The contraction in non-interest income from corporate and investment banking activities reflects reduced trade flows and lower equity trading volumes.

EXHIBIT 1

Saudi Banks’ 2016 Profits versus 2015

Sources: Saudi Arabia Stock Exchange and Moody’s Investors Service

Increased provisioning also weighed on banks’ profits, particularly for loans to the building and construction industry. This affected mainly banks with large corporate banking activities. Retail banks such as National Commercial Bank (A1 stable, baa11

), Al Rajhi Bank (A1 stable, a3)

1 The bank ratings shown in this report are the bank’s deposit rating and baseline credit assessment.