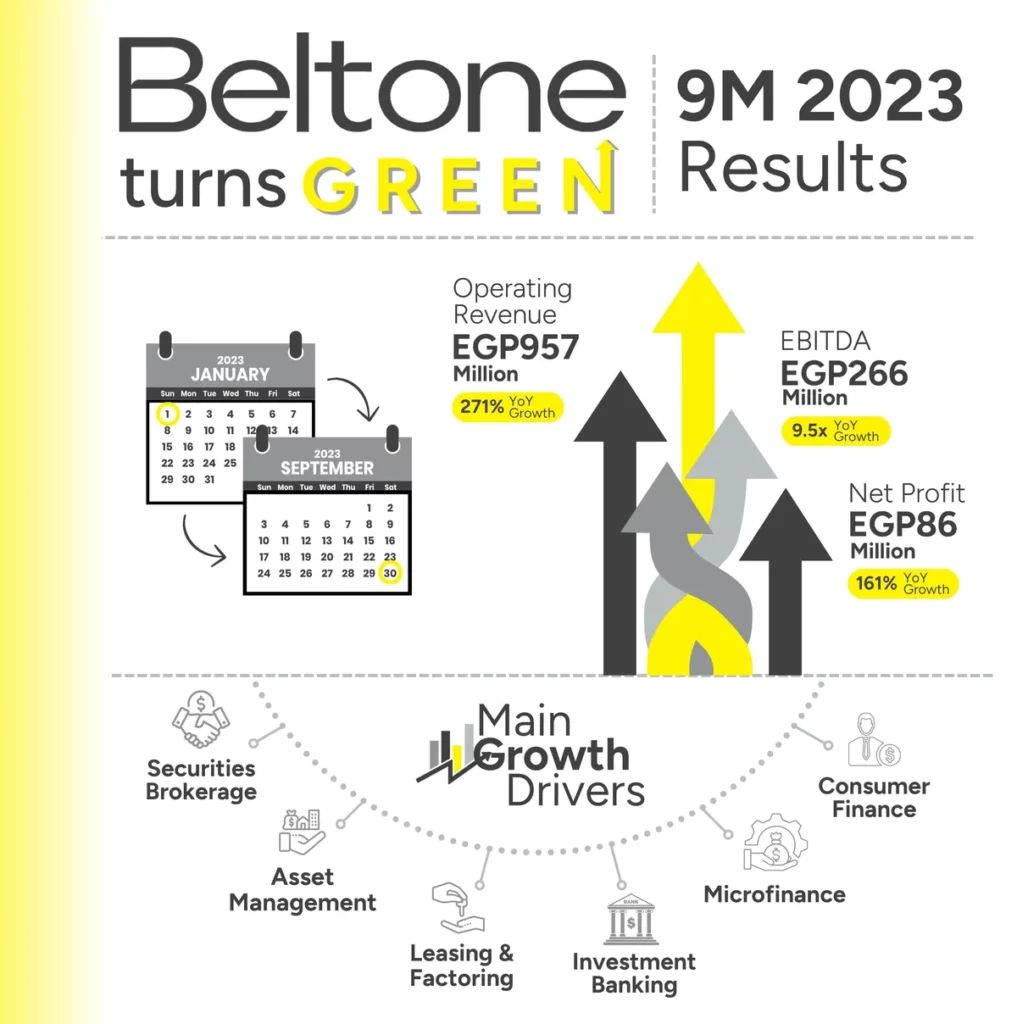

Beltone’s Operating Revenue Hits EGP 957 Million in 2023 with Impressive 271% Growth YoY – Net Profit Soars to EGP 86 Million, Marking a 161% Increase and Major Turnaround After 3 Years of Losses

Cairo, November 27, 2023: Beltone Financial Holding (“Beltone” or “the Company”), one of the fastest growing financial institutions, announces its consolidated financial and operational results for the period ending September 30, 2023.

Beltone’s new management embarked on a journey of restructuring and transformation, following the acquisition. Many functions were revamped, policies and procedures were deployed, the business was adequately capitalized through the recent Rights Issue, built a best-in-class team to manage, grow and diversify Beltone’s offerings and income stream while unlocking synergies.

Furthermore, the strategy entailed Beltone’s transformation into a digital data-driven organization. Data Science and Analytics function is a powerhouse of innovation and strategic intelligence within Beltone and a unique differentiating factor within the industry.

Beltone Academy was established with a vision to be recognized as a leading financial education institution, empowering individuals with the knowledge and skills to navigate the complexities of the financial world.

In 9M2023, the Company witnessed remarkable transformation and restructuring that led to a solid turnaround. Operating Revenue increased to EGP957 million, a growth of 271% YoY driven by strong operational performance across the Non-Banking Financial Institutions (“NBFIs”), complemented by the Investment Bank and Other Ventures.

EBITDA amounted to EGP266 million in 9M2023, a growth of 9.5x YoY. Net Profit recorded EGP86 million, an increase of 161% YoY, compared to a Net Loss of EGP140 million during the same period last year, a strong testimony to the restructuring and turnaround that took place over the past year.

The NBFIs Operating Revenue recorded EGP478 million in 9M2023, a growth of 680% YoY. Leasing Revenue was one of the main drivers behind said growth, followed by Consumer Finance, Microfinance and Venture Capital.

The Investment Bank Operating Revenue amounted to EGP198 million in 9M2023. The Securities Brokerage Margin Lending Portfolio grew to EGP621 million during 9M2023, increasing 2.1x YoY. While Assets Under Management reached EGP23 billion, a growth of 16% YoY.

As part of Beltone’s transformation and restructuring strategy, the Company launched its new revamped brand identity. The Consumer Finance arm was rebranded from “BelCash” to “seven”, reinforcing Beltone’s position as a leading Consumer Finance powerhouse which offers innovative fintech payment solutions that bridge the gap between financial capability and aspiration.

Beltone Leasing received regulatory approval on adding Factoring to its lines of business during 3Q2023. Furthermore, Beltone Mortgage Finance received regulatory approval on its license in November 2023, which brings Beltone’s existing licenses to 16 licenses.

Beltone Venture Capital increased its investments during 9M2023, by investing in SehaTech, WayUp Sports, Bosta and Ariika.

In September 2023, Beltone acquired 100% of Cash for Microfinance, a leading FRA-licensed microfinance provider in Upper Egypt, with ambitious plans to strengthen its reach by increasing its branches capacity across Egypt and launch many mobile branches, to make its financial services available to customers especially in remote areas.