75% of Saudi consumers trust digital payments for online and in-store shopping: Visa-Saudi Payments survey

75% of Saudi consumers trust digital payments for online and in-store shopping: Visa-Saudi Payments survey

– Consumers reported improved technology and safety measures helped them retain confidence in digital payments.

– 85% drop in Cash on Delivery during pandemic as consumer trust in digital payments continues to rise

– Findings suggest digital payments adoption will continue to grow in-store and online post-pandemic

Riyadh, Kingdom of Saudi Arabia, A new study revealed that 75% of consumers surveyed in Saudi Arabia have confidence in digital payments for in-store shopping and payment on delivery, while cash on delivery saw an 85% plunge during the pandemic. Biometrically-verified payments also scored high with more than 72% of consumers surveyed saying it is secure, according to the 2021 Stay Secure survey launched by Saudi Payments through the National Payment Scheme – mada, and the world leader in digital payments, Visa, as part of their annual Stay Secure consumer education campaign.

According to the study, eCommerce and contactless payments have increased in popularity and use since the start of the pandemic, where the use of digital payments (contactless cards + mobile wallets) for payment online or on delivery has grown by an average of 70%. Consumer feedback reinforces the belief that there is no reversal of this trend, with 47% of consumers saying they are less likely to use COD and 46% are more likely to use contactless payment methods in the future.

Trust driving consumer preference in contactless and digital payments mitigate concerns

Three-fourth of consumers (75%) have high levels of confidence in digital payments (contactless cards and mobile wallets) for shopping in-store and payment on delivery, an increase since the start of the pandemic. Top reasons consumers gave for their trust include convenience (59%), speed (55%), avoiding human touch (53%), it being an innovative way to pay that gives the consumer more control (the mobile or card never leaves consumer’s hand during transaction) (51%).

Biometrically-verified payment methods utilizing handprints or face prints – such as mobile wallets – also scored high with consumers with more than seven out of 10 (72%) saying it is secure, and 49% saying it gives them complete control as it never leaves their hand in a transaction and eliminates the hassle of having to remember passwords.

Knowledge of the technology that protects digital payments is a driver of consumer trust. Among consumers who trust digital payments, a majority (57%) said their knowledge and understanding of how their digital payments are protected by innovative technologies such as tokenization has helped build their confidence in cashless options. Those who do not have adequate levels of knowledge of the technology, still have lagging doubts about the safety of digital payments. For example, 36% fear misuse of lost or stolen contactless cards mostly due to a lack of understanding of how the technology works (18%). These findings reinforce the importance of continual education on safe digital payment practices among consumers to maintain their trust.

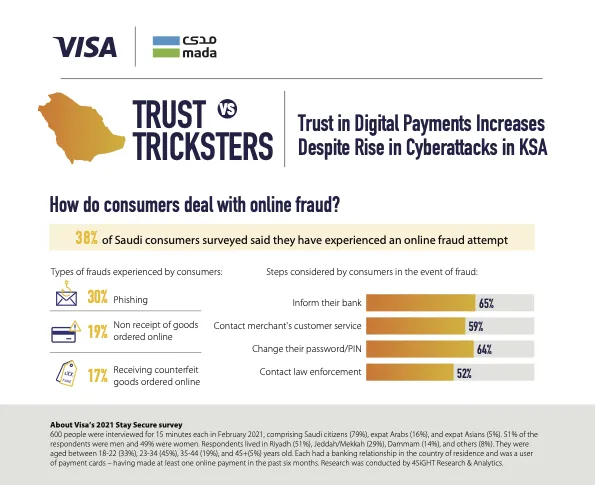

Neil Fernandes, Visa’s Head of Risk for Middle East and North Africa, commented, “As our survey results indicate, consumers have fully embraced digital payments in the COVID-19 era but that does not come without risks. As consumers shift online, fraudsters have sought opportunities to exploit these changes in how people pay for goods and services. This is why constant consumer education is so much more important than ever before. The fact that majority consumers surveyed would contact banks and law enforcement in the event of fraud is a credit to the diligent efforts of our partners in Saudi Arabia who are committed to keeping consumers safe and empowering them to use digital payments and online channels with confidence. However, as an industry we cannot afford to let our guard down. Our ongoing Stay Secure campaign is our effort in bringing together all participants in the payments ecosystem to work together to advance efforts to educate consumers on how to stay vigilant, identify potential fraud, and what actions they should take if they are affected.”

The survey corresponds with the launch of Visa’s fourth annual “Stay Secure” social media campaign on Facebook (@VisaMiddleEast, @mada) in partnership with Saudi Payments. The campaign reinforces safe digital payment practices and reminds consumers on how they can protect personal data even as they enjoy the benefits of speed and convenience of eCommerce and contactless payments through Near-Field Communication. The Saudi Arabia Stay Secure webpage also includes fraud prevention tips for consumers and information on security features of digital payments.