Moody’s maintains stable outlook for Egyptian banks reflecting strong funding and profitability

Moody’s Investors Service has maintained its stable outlook on Egypt’s banking

system, reflecting the rating agency’s expectation that the country’s banks will continue to benefit from a stable

deposit base, high local currency liquidity and strong profitability over the next 12-18 months.

Moody’s report, entitled “Banking System Outlook — Egypt: Stable outlook reflects strong funding and

profitability despite low capital” is available on www.moodys.com. Moody’s subscribers can access this report

via the link provided at the end of this press release. Please note that this report does not constitute a rating

action.

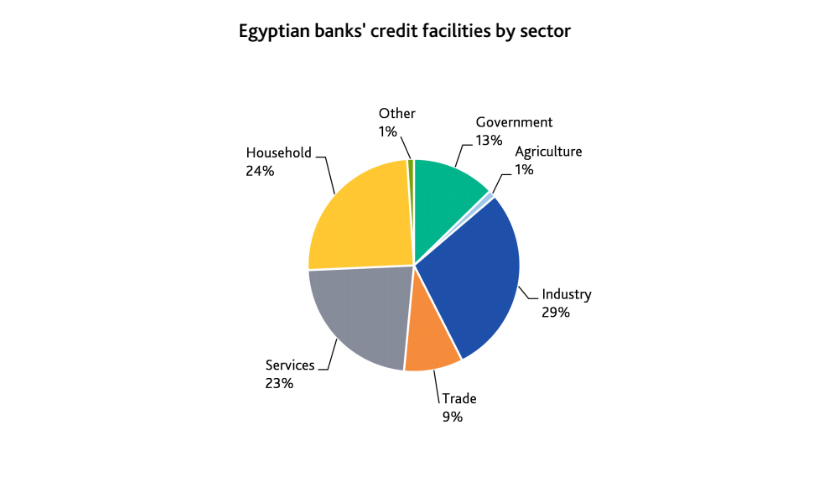

“We expect Egypt’s gradually recovering economy to continue to provide banks with plenty of business

opportunities,” says Melina Skouridou, an Assistant Vice President at Moody’s. The rating agency expects

GDP growth to slow to 3.5% for the fiscal year ending in June 2016 (4.2% FY2015), but accelerate to 4.0% in

2017. “As a result, we anticipate domestic loan growth of around 15% over the next 12-18 months, although

Egyptian banks’ increasing exposure to the sovereign will remain a key risk, given modest capital buffers.”

Asset quality metrics are likely to improve over the outlook horizon, in Moody’s view. The rating agency expects

the system’s ratio of nonperforming loans to gross loans to decline to around 6.0% by December 2016 from

6.8% in December 2015. This will likely be the result of the settlement of certain legacy cases which have

lingered on Egyptian banks’ books. Asset risks, however, will remain high, especially those amongst the

troubled tourism-related borrowers. Over the longer term, government-mandated lending to small and midsized

businesses (SME) could compromise asset quality. The Egyptian banking system’s capital buffers

against asset risk are low, particularly when Moody’s adjusts for its heavy exposure to government securities.

On the other hand, Moody’s expects Egyptian banks to maintain their high liquidity buffers, with ample, lowcost

customer deposits continuing to finance banks’ lending growth. “Migrant workers send home large flows of

remittances, which will likely remain a significant driver of deposit growth over the next 12-18 months,”

explains Ms. Skouridou. “In addition, deepening financial inclusion will further support deposit growth.”

However, the rating agency notes that foreign currency liquidity is under pressure, due to the severe dollar

shortage, although this should partly be mitigated by increasing foreign direct investment in the medium term.

Profitabilty for Egypt’s banks will likely remain robust, with the sector’s return on average equity at 18.9% and

return on average assets 1.3% as of December 2015, which compares favorably with similarly-rated banks in

the North Africa and Levant region. Moody’s considers that banks’ profitability will continue to benefit from their

high exposure to high yielding sovereign debt as well as from rising interest rates, central bank regulations

allowing banks to finance certain SME loans from their reserves, and high lending volumes.

Finally, Moody’s considers that while the Egyptian government remains willing to support the banking system,

its capacity to do so is limited. Over the past three years, the authorities’ capacity to support any bank in

financial difficulty has weakened as its finances have deteriorated.