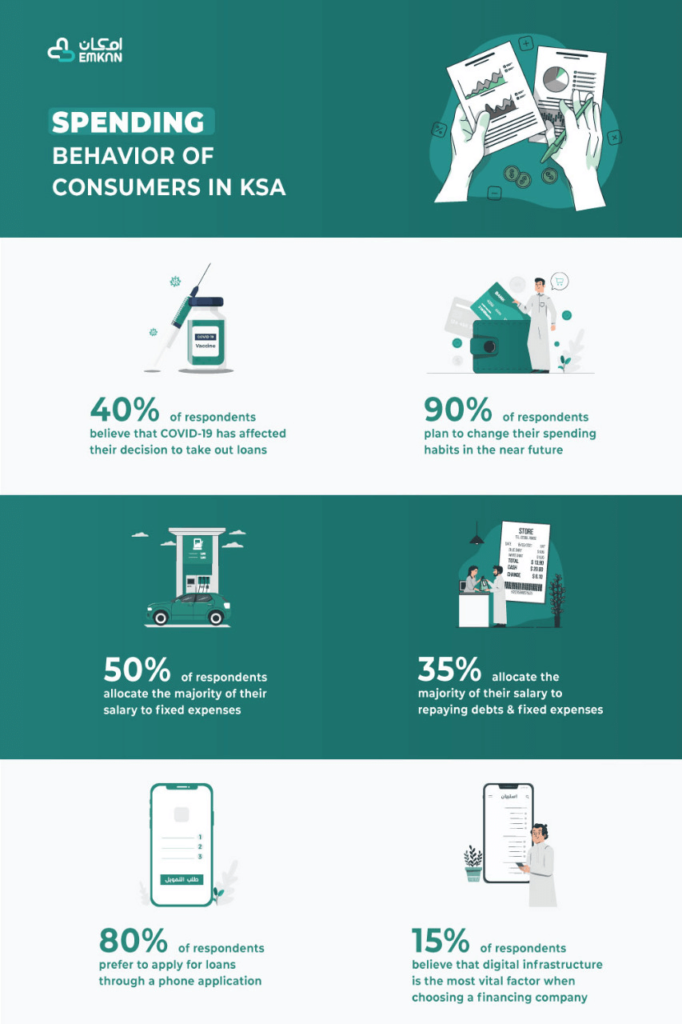

EMKAN SURVEY REVEALS SHIFT IN CONSUMER SPENDING BEHAVIOUR AND ACCELERATION IN DIGITAL ADOPTION FOR FINANCIAL INSTITUTIONS

RIYADH, Saudi Arabia, July 7, 2021 – The economic fallout of the COVID-19 pandemic combined with disruptions across various sectors has accelerated changes to consumer spending and lending behaviours, according to a survey conducted by Emkan, a financial company that provides innovative financial solutions across the Kingdom of Saudi Arabia.

The survey consisted of responses from 4,076 consumers across Saudi Arabia and brought to light several trends that have surfaced over the past year. According to the survey, consumers across Saudi Arabia have shown resilience in weathering the outbreak. However, results dictate that there have been several shifts in consumer behaviours including decisions to receive financing, drivers to spend money and appreciation towards digital infrastructure.

Saud Al Ghonaim, CEO at Emkan Finance Company, said: “This region is one of the most progressive and innovative in the world when it comes to technology. The evolving consumer behaviour of a tech-savvy population, paired with exponential gains in both speed and productivity, has allowed digital adoption within the financial solutions sector to be a vital contributor to growth and success.”

Shifting spending habits

With a region-wide reduction in household income due to job redundancies or reduction in hours, the shift to spending on value and essentials rather than entertainment and luxury has been heightened.

This is evident with 35 percent of Emkan’s survey respondents having revealed that they allocate the majority of their salary to repaying debts and fixed expenses. To further mitigate the implications of the pandemic, 90 percent of the survey respondents have also revealed that they plan on changing their spending habits in the near future. KSA nationals and residents also appear to be paying closer attention to their spending habits with 50 percent of respondents claiming to check their credit reports on a monthly basis.

In the coming period, customers are also planning on taking out loans to consolidate debt or fund large expenses with 32 percent of respondents planning on buying a home in the next 12 months.

Reshaping lending behaviour

With 40 percent of respondents believing that COVID-19 has affected their decision to take out loans, banks and lending solutions have also implemented measures to counteract the effects of COVID-19. Measures included rescheduling loans, offering temporary deferrals on monthly loan payments, and reducing fees and commissions.

“Throughout the past year, the outbreak has depressed global financial markets and had severe implications on economies globally. This has subsequently led to deteriorating cash flows in sectors such as tourism and travel, which were most impacted by COVID-19. Poorer credit quality within these sectors has increased reliance on the banking and financial solutions sector – with a growing need to fund development and keep business afloat,” said Al Ghonaim.

Accelerating digital adoption

Before the pandemic, consumer expectations were changing, and through digital and technology transformation programs, financing solutions have also been shifting the way they delivered products and services to consumers. According to Emkan’s survey, 50 percent of respondents claim to depend on traditional banks for issuing loans, while 26 percent of people depend on financing companies which indicates FinTech lending is becoming increasingly popular in the region.

Al Ghonain added: “FinTech lenders are gaining popularity and are now major suppliers of credit to small businesses, individuals and enterprises. These institutions have also played an important role in the recovery from the pandemic, which placed digital adoption at the core of recovery.”

“Consumers who were previously resistant to using online payment channels were forced to amend their purchasing behavior and heavily rely on online shopping since the crisis started. This has led to a higher dependency on digital infrastructure as consumers realised that purchasing goods and services on their smartphones was not only easy but convenient too. Nowadays, customers are used to obtaining services when they want it, where they want it.”

With the onset of the pandemic, there has been a heightened requirement for digital infrastructure to be implemented within the process of providing financial loans as 80 percent of respondents prefer to apply for loans through a phone application and 15 percent of respondents believe that digital infrastructure is the most vital factor when choosing a financing company

“At Emkan, we have remained strong, steadfast and open to digital innovations in response to the surfacing consumer requirements. Such practices are the cornerstones of a competitive, high-productivity economy and will allow the financial sector to further grow and flourish,” concluded Al Ghonaim.