Egyptian Banks Will Benefit From Devaluation and Rising Interest Rates

On 14 March, the Egyptian central bank devalued the Egyptian pound by 14% versus the dollar to EGP8.85. Three days later it increased the country’s benchmark interest rate by a substantial 150 basis points to 10.75%.

The currency devaluation comes at a time of low net international reserves and is credit positive both for Egypt (B3 stable)1 and its banks. Bringing the official exchange rate closer to unofficial market rates will make the country’s assets more attractive for foreign investors and will improve trade competitiveness. Increasing foreign investment inflows will support economic growth, the long-term beneficial effects of which we expect to outweigh near-term pressure on capital and borrowers’ affordability.

The government recently lowered its growth forecast for this year to between 4.0% and 4.25% from 5.0% previously and we expect 3.5%. The growth outlook was weighed down by the decline in tourism, lower investment, and weakened industrial activity, caused by the shortage of dollars which makes it difficult to import raw materials.

The nonoil Private Sector Purchasing Managers Index, constructed by Emirates NBD (Deposit rating: Baa1 positive), declined to 44.5 in March of 2016, compared with 48.1 in February. Over the longer term, increasing foreign investment will ease liquidity pressures in foreign currency the banks are facing.

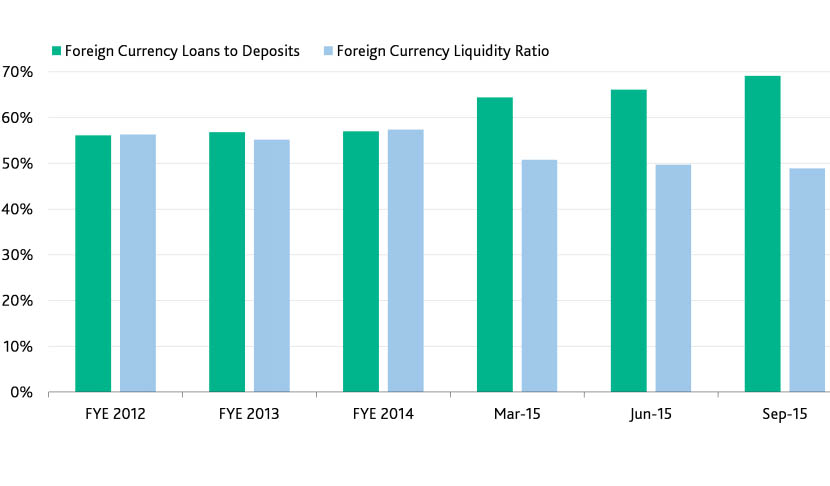

This is caused by strong demand for dollars by Egyptian companies (see Exhibit 1) which exceeds the number of dollars supplied to the banks by their exporting customers and by the central bank. The ratio of loans to deposits in foreign currency increased to 69% as of September 2015 from 57% as of December 2014 while the ratio of foreign currency liquid assets, consisting of cash, placements with banks, and government securities in foreign currency the banks have invested in, to total assets declined to 49% in September 2015 from 57% at year-end 2014.

If we exclude government securities, which are usually reinvested at maturity, the liquidity ratio declines to 27.5% MOODY’S INVESTORS SERVICE FINANCIAL INSTITUTIONS This publication does not announce a credit rating action. For any credit ratings referenced in this publication, please see the rating tab on the issuer/entity page on www.moodys.com for the most updated credit rating action information and the rating history.

2 27 April 2016 Banks: Egypt: Egyptian Banks Will Benefit From Devaluation and Rising Interest Rates Exhibit 1 Demand for foreign currency loans is increasing Source: Central Bank of Egypt In addition, the central bank’s decision to raise interest rates will benefit profitability, owing to banks’ large investments in short-maturity Treasury bills which will now be rolled over at higher rates, boosting net interest income.

Egyptian banks have a large exposure to government securities, accounting for around 44% of banking system assets as of December 2015. These benefits outweigh short-term effects on capital and debt repayment capacity. In the immediate future, the weakening currency will exert mild pressure on the banks’ already low capital buffers.

This is because US dollar-denominated banking assets will appreciate relative to the banks’ EGP-denominated capital, lowering the capital ratio. For example, we estimate that all else constant, a 20% devaluation would lower the banking sector’s reported Tier 1 capital ratio by 50 basis points to 11.0%.

The declining currency and interest rate increase could also pressure the debt repayment capacity of certain borrowers, mainly importers who will be unable to pass on the higher cost without hurting their business. However, we expect the negative effect on banks’ asset quality from loans to unhedged borrowers to be contained since central bank regulation requires borrowers of foreign currency loans to have revenues in the same currency. In addition, leverage is low in Egypt, and retail/consumer debt is capped at 35% of the net salary.