The 10 Digital Transformation Journeys of the Telco

By: Martin Creaner, Consultant and the Chief Digital Transformation strategist for Huawei SPO Business Research Lab and Writer of “Transforming the Telco” Book

February 24, 2021

There’s an ancient parable about a group of blind men examining an elephant and trying to work out what sort of creature it really is. Each touches the elephant in a different place: the trunk, the tusk, the leg, the tail, and so on. Each comes to a radically different conclusion about what sort of animal they’re dealing with. Some believe it’s a snake; some think it’s a bull, some a wall, some a rope. While this parable has its root in texts over 2,000 years old, it expresses a universal truth. When we don’t manage to take in the full picture, we can end up drawing wildly diverse conclusions.

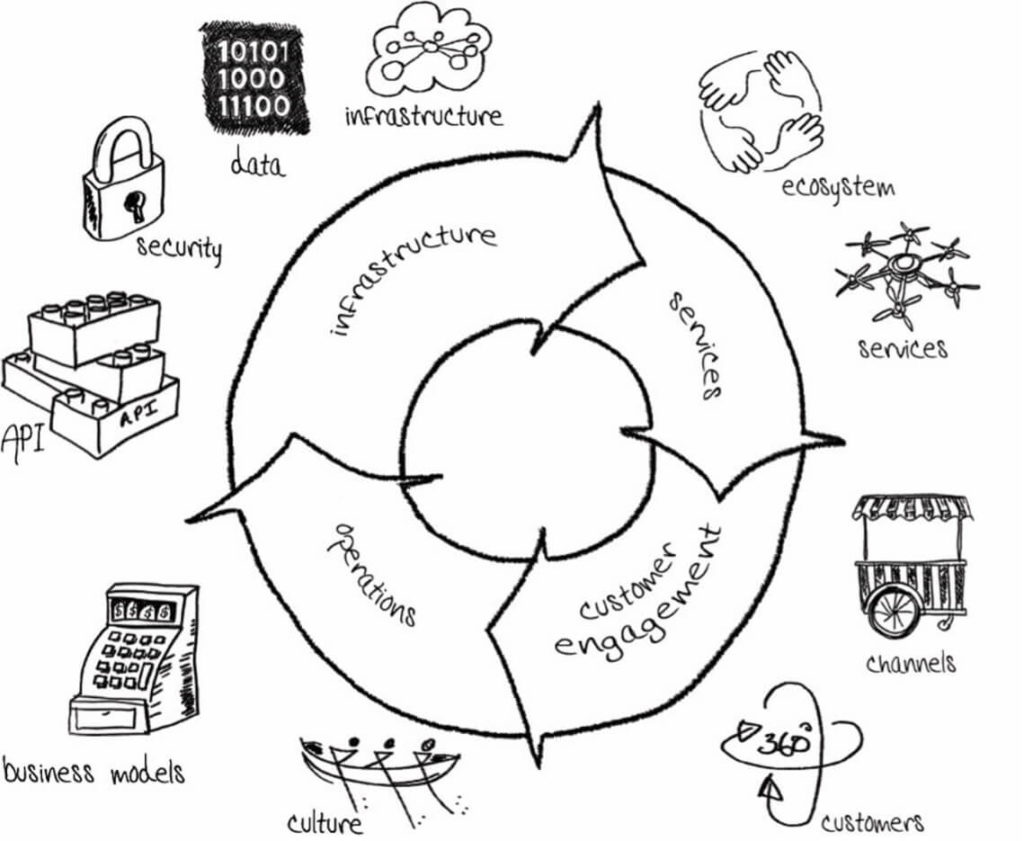

Digital transformation runs into the same problem. We all become obsessed with the pieces we’re interested in. Accordingly, we see transformation as primarily a technology challenge, a new digital service opportunity, or a cultural change, or a customer engagement issue. Transformation is all of the above and more.

In my recent book Transforming the Telco I talk about telco digital transformation in 10 distinct journeys that embrace every aspect of the telco. Each journey represents a distinct transformation challenge that Telco must address to deal with digital transformation fully.

- Journey 1: From discrete network elements to an autonomously managed, virtualized communications and cloud infrastructure.

- Journey 2: From reactive product-specific security to a uniformly orchestrated security-centric organization.

- Journey 3: From limited data exploitation to a uniformly orchestrated data-centric enterprise.

- Journey 4: From closed management systems to an open API-driven platform-centric architecture.

- Journey 5: From a limited portfolio of traditional services to a diverse portfolio of digital services.

- Journey 6: From managing a limited set of suppliers to thriving in a vibrant ecosystem of partners.

- Journey 7: From operating a limited set of Business Models to utilizing multiple Business Models in core and adjacent markets.

- Journey 8: From a traditional Telco organization and culture to a digitally native organization and culture.

- Journey 9: From focusing on traditional channels to adopting multiple channels to market.

- Journey 10: From one-dimensional management of customer relationships to 360o omnichannel management of the customer experience.

Figure 1: the 10 transformation journeys of the Telco

The complexity and breadth of digital transformation mean that the effective transformation of the telco will take many years. Furthermore, this transformational change cycle is out of sync with the speed of change in the industry in terms of technology and business model. As a result, many telcos have embarked on comprehensive digital transformation programs only to find 12 months into the program that there has been a game-changing shift in technology or competition that forces them to re-evaluate their entire transformation plan.

In each of the 10 transformation journeys, it’s possible to find a range of interesting and valuable projects that represent real transformation progress. While telcos understand each of the 10 transformation journeys’ potential scope, there’s a consistency to which bits they’re comfortable addressing and which pieces they try to steer clear of. As with any enterprise, they’re looking for high-impact initiatives for the least cost/risk.

Over the past 18 months, we’ve seen strong transformation progress on some of the journeys such as virtualization and cloudification of infrastructure (core, RAN, and Edge), streamlining of the customer journey and the end-to-end customer experience, and in the trialing of a whole range of new B2C and B2B digital services. Unfortunately, we’ve seen much less progress in the whole area of cultural change, the shift towards being cloud-native, and the evolution of the telco business model to compete with the new generation of digital service providers.

Making the 5G business case work

Competing at the digital services level is not simply nice to have the digitally transformed telco. In a recent work I was involved in with Keystone Consulting, we looked at the business case for 5G in 2025 – assessing the new “connectivity-based revenue” potential that 5G offers against the total cost of rolling out operating 5G. The first simple but devastating takeaway from this analysis is that the cost of the rollout of 5G in 2025 will be higher than the new “connectivity-based revenue” that will be generated from consumers and enterprises by 5G.

This means that if the telco rolls out 5G and behaves in the same way as it behaved with 2G, 3G, and 4G, it will not return on that investment. And the gap between “new connectivity-based revenue” from 5G and the cost of rolling out and operating a 5G network will be substantial – to the order of approximately US$160 billion per annum (somewhere between 6 to 10 percent of the value of the industry).

There are, of course, alternative projections on the size of the 5G industry by 2025 that vary in scale from the above numbers. Still, many of them agree with the fundamental point that new connectivity-based revenue growth from 5G will be less than the cost of deploying and maintaining that 5G network. Furthermore, most telcos’ experience in rolling out 5G during 2019 and early 2020 reinforces this argument. There are very few telcos that have managed to price 5G at any significant premium to 4G. As a result, the long-term success of 5G will depend on whether the telco can use it as a mechanism to open up new “non-connectivity” revenue sources.

Finding the new revenue

There is no shortage of ideas for where this new “non-connectivity” revenue will come from. Telcos are exploring everything, including Industrial IoT, digital health, home entertainment & gaming, smart retail, smart events, smart homes, connected cars, and beyond, to find the sweet spot for generating new 5G digital service revenue to close that predicted 5G revenue gap. Each of these opportunities shows promise assuming that telcos can focus on the right use case, orchestrate the right ecosystem of players to bring a complete solution to the customer, and execute at speed the market demands.

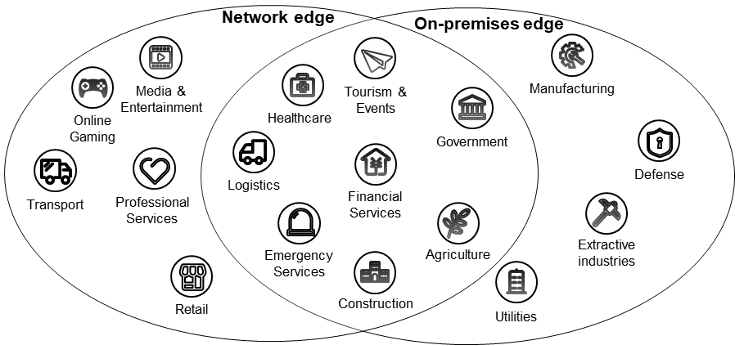

One of the key differentiators that the telco may be able to bring to bear in securing an opportunity in these new services will come through their deployment of edge cloud capabilities, either directly on the premises of the target industry, or at the edge of the network, accessible by all. Edge promises to be a critical capability for a wide range of emerging 5G 2C and 2B digital services and whoever controls the edge will be able to position themselves at the heart of new service revenue opportunities.

Figure 2: Operators interest in different edge use cases

A good example is an opportunity surrounding home entertainment & gaming. The popularity of online gaming is high and set to continue to increase demand for all types of advanced networking infrastructure from fiber to the home to 5G mobile private networks.

A growing number of partnerships are being put in place between telcos and online gaming providers such as Google Stadia and Hatch gaming, and the services are proving popular. This is good news for the telco, but it’s at the touchpoint between the network and the cloud that things really get interesting. The hyperscalers are seeing increasing demand for more responsive cloud services to meet this market’s needs, and this requires critical parts of the cloud service to be hosted near the consumer – at the edge. Telcos are currently ramping up their investments and partnerships to ensure that they have an important role in the future of the edge.

The importance of platforms and their business models

Whichever services telcos eventually hit on to close the 5G revenue gap, it’s widely accepted that platforms will play a hugely important role in delivering these services. Multi-role platforms are becoming the predominant business model in the digital era. They enable the platform owner to grow revenue and market capitalization quicker and at a lower cost than traditional business models.

A generic telco platform’s capabilities will be hugely important in enabling the telco to establish a strong position in either B2C or B2B new digital services. These capabilities will include the traditional strengths of the telco infrastructure offerings, combined with the more advanced capabilities that next-generation autonomous networks are just now beginning to offer, such as network slicing, customized on-demand, and self-serve networks. On top of these capabilities will be the BSS and operations systems incorporated into the platform to offer a complete solution to the customer.

Time and again, vertical industries have expressed their preference for buying “solutions” from telcos rather than simply buying “connectivity,” so of critical importance to the future success of the telco will be how they develop this platform and then build the necessary ecosystem to bring as complete a solution as possible to the end customer.

The future structure of the telco

The decisions facing the telco regarding where to position themselves on the digital landscape are huge. Taken as a whole, the traditional telco industry would be seen to have moderate expertise in the area of cloud and AI and low expertise in the area of platforms and ecosystem development. If they do nothing, their cloud and AI expertise will atrophy, and they are likely to end up as a hyperscale dependent telco in an unenviable low-margin position, reliant on their hyperscaler partners for much of their network and platform infrastructure. This industry position can be made to work for telcos that are willing to compete primarily on a price for a limited set of undifferentiated services.

The telco also has the option of investing in the development of their cloud and AI expertise to retain in a position of power in a world of virtualized networks and cloud edge services. I call this the transitional telco. In the short term it will prove to be an important position in the industry, but may not be tenable in the long term as the speed of innovation of the hyperscalers may make it difficult for these telcos to compete on price with telcos that are simply taking whatever network and edge capability the hyperscalers are offering.

Instead, they could focus their investment on developing their platforms and ecosystems and become highly competitive service players. This could prove a good position for the telco to adopt, particularly if they can leverage their already impressive existing customer base and relationships and upsell into other services. However, this position has relatively low entry barriers, and so constant innovation by the telco in terms of services and business models will be essential to thrive in this position.

Ultimately, the telco could choose to go big and invest in both their cloud/AI capabilities and their platform/ecosystem capabilities. To do this, the telco will need the money and have to take a long hard look at themselves and their internal processes in terms of how they stack up against the real cloud-native and digitally native players. However, the few that manage to become this cloud-native telco successfully have the opportunity to become a true digital giant in the coming decades.

Conclusions

The telco’s future will be determined by how well the telco handles the enormous challenge of 5G monetization and digital transformation. If they handle it well, the telco can secure a position as one of the engines of the digital economy’s growth for the coming decade. If they handle it poorly, they will slide backward to become a utility connectivity provider competing primarily on price. The decisions the telco takes today in terms of investment in cloud, AI, platforms, and ecosystems will resonate out into the future.