Refinitiv & ICD 2020 Report: Global Islamic Finance Assets Expected to Hit $ 3.69 trillion in 2024

- Malaysia, Indonesia, Bahrain, UAE and Saudi Arabia ranked as the top five developed countries globally in Islamic Finance

- Indonesia jumped to second place in IFDI ranking backed by government knowledge initiatives

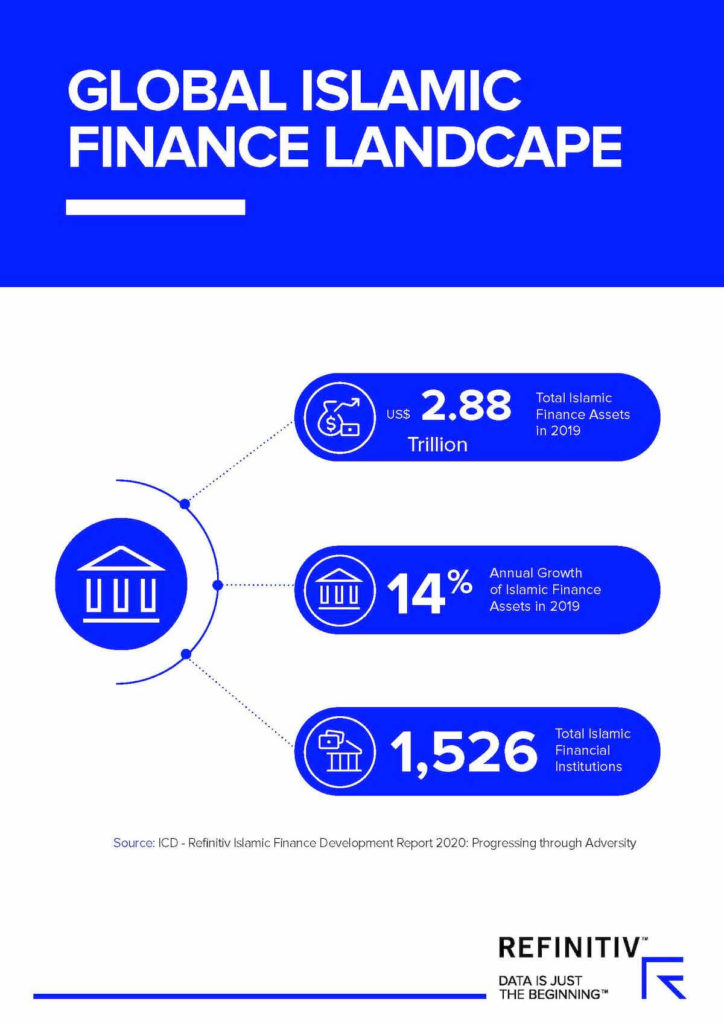

- Islamic finance assets increased 14 percent to US$ 2.88 trillion in 2019, the highest recorded growth for the industry since the global financial crisis

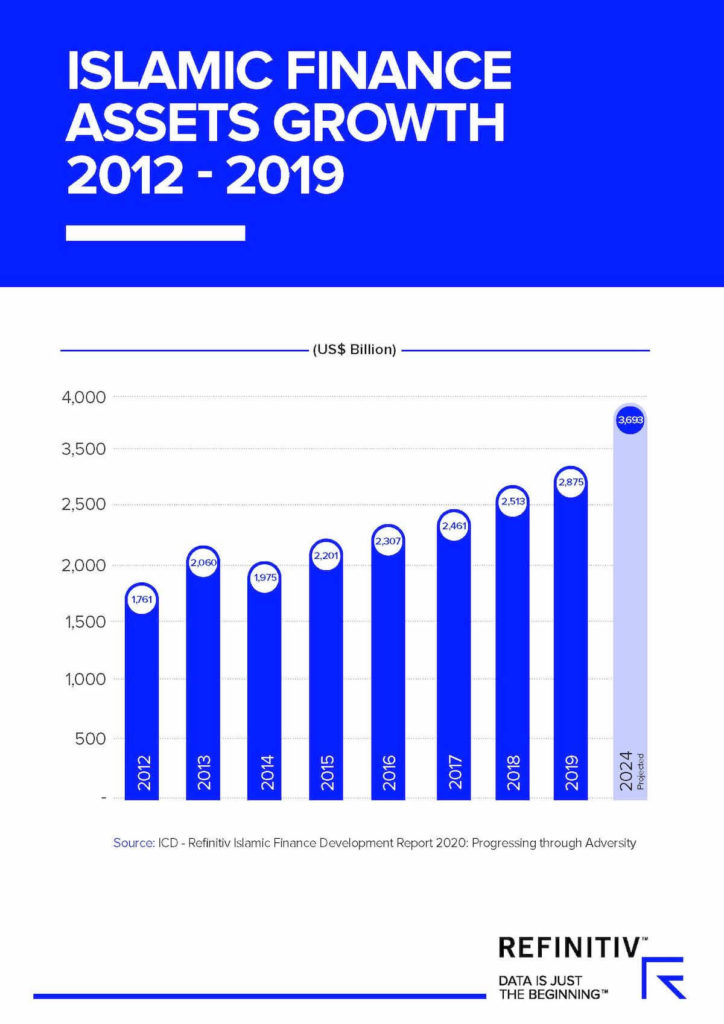

SAUDI ARABIA – Global Islamic Finance assets are forecast to reach $ 3.69 USD trillion by 2024 according to the 2020 Islamic Finance Development Report released today by Refinitiv and the Islamic Corporation for the Development of the Private Sector (ICD), the private sector development arm of the Islamic Development Bank (IsDB).

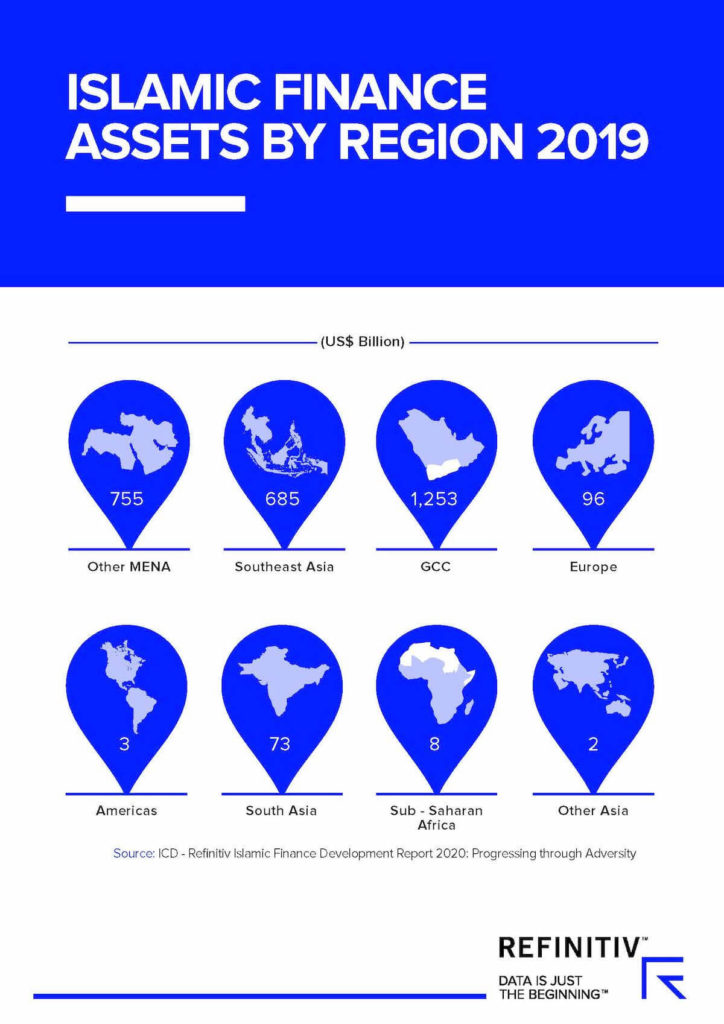

According to the report, global Islamic Finance assets increased by 14 percent year-on-year totaling $ 2.88 USD trillion in 2019. The Islamic Finance assets of the Gulf Cooperation Council (GCC) reached $ 1.2 USD trillion in 2019, followed by the Middle East and North Africa (MENA) excluding the GCC at $755 USD billion, and Southeast Asia at $ 685 USD billion.

The Islamic banking sector contributes to the bulk of global Islamic finance assets. The sector grew 14 percent in 2019 to $1.99 trillion in global assets. This compares with just 1 percent growth in 2018 and the average annual growth of 5 percent from 2015 to 2018.

According to the report, the top five developed countries in Islamic Finance are Malaysia, Indonesia, Bahrain, UAE, and Saudi Arabia. This year, Indonesia showed one of the most notable improvements in the Islamic Finance Development Indicator (IFDI), moving into the second spot for the first time due to its high knowledge and awareness ranking.

David Craig, CEO of Refinitiv, said, “A lack of relevant, actionable data has held back the Islamic finance industry for too long. That’s why the Islamic Finance Development Indicator is now such an important tool for policymakers and market participants. This market is worth nearly $3 trillion already. I’m excited about its future, particularly when it comes to Sukuks, and because Islamic finance has so much in common with sustainable finance – one of the most significant global business trends today.

Ayman Sejiny, the CEO of ICD, said: “We believe that the analyses and information provided in this year’s report will serve as a vital reference point for the state of the Islamic finance industry during these difficult times and we remain convinced that Islamic finance can play a major role in alleviating the social and economic consequences of the Covid-19 pandemic.”

The report covers 135 countries and is based on five key metrics: Quantitative Development, Knowledge, Governance, Awareness, and Corporate and Social Responsibility (CSR).

According to the report, Green and Socially Responsible Investments (SRI) increased in the UAE and Southeast Asia in 2020. The pandemic was a game-changer as several Islamic banks reported losses and reduced profits throughout this year. The pandemic has also led to growth in some industry areas as some regulators turned to Islamic finance to mitigate the economic impact.

Corporate Sukuk issuance has also picked up after a cautious halt in the first quarter of 2020. The report indicates that companies are taking advantage of low borrowing costs to shore up their finances while the pandemic continues to batter trade and economies.

Please click here to download the latest edition of the IFDI Report

Please click here to learn more about the indicator and the IFDI Database

Please click here to learn more about Refinitiv’s Islamic finance offerings